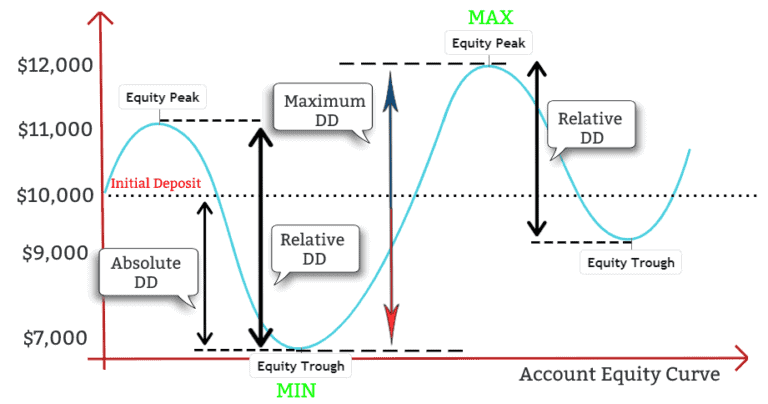

Two commonly used metrics to measure risk in trading systems are drawdown and standard deviation. It is important to have an acceptable maximum drawdown level at both the strategy level and the portfolio level, otherwise, we will be exposed to too much risk and could end up with large losses that could take a long time to recover. However, if the drawdown timing is different and one trading system makes new equity highs while the other one is in drawdown then combining these two strategies into a portfolio reduces the overall risk and smooths our returns. If the drawdown timing between two strategies is highly correlated then combining them will not reduce the risk in the portfolio. We can also use the deepest drawdown and the profile of drawdowns to compare different strategies (or asset classes) to decide which one offers the best balance of return and risk for our investment objectives.ĭrawdown is also extremely useful when assembling a portfolio of trading strategies. They are a measure of downside risk and can give us an idea of the level of volatility that we should be prepared for in our trading system.

VISUAL OF MAXIMUM DRAWDOWN STOCKS SERIES

The deepest drawdown in our backtest gives us an indication of how much our equity could drop when we experience a losing streak or series of losses.

The deepest drawdown in the backtest tells us what the historical risk was for the trading systems we are analysing. What is the definition of drawdown in stock trading? More Articles About Drawdown in Trading.

VISUAL OF MAXIMUM DRAWDOWN STOCKS HOW TO

How to Think About Drawdowns in Mutual Funds.How to reduce your trading system’s maximum drawdowns.The causes of drawdown in stock trading systems:.How do you turn off a trading system to reduce drawdown?.The relationship between drawdown depth and drawdown duration.Using Monte-Carlo Simulation to Better Understand Maximum Trading Drawdown (MDD).How to determine system maximum drawdown (MDD) based on a backtest.Blowing up your account and starting again.Impact on compounding & Interaction with your other trading systems.The trading psychology importance of managing drawdowns.Why you need to manage your drawdowns and keep them small when trading stocks.The important difference between trade drawdown and portfolio drawdown.Drawdown vs Standard Deviation – Which is a better measure of risk.What is the definition of drawdown in stock trading?.Learn 4 Causes of drawdown & 5 ways to reduce maximum drawdown in your trading - Table of Contents Toggle

0 kommentar(er)

0 kommentar(er)